This project had two phases...

Phase one: Aimed to resolve inefficiencies in one of Entera’s core workflows, affecting both client and internal user success

My roles in phase one: Quickly understanding technical requirements and limitations. Translating well scoped requirements into low and high fidelity mockups.

Click here if you want to view phase one now

Phase two: Created new platform tools to optimize workflows and improve the experience for multiple user types

My roles in phase two: User research and exploration for partially scoped requirements. Multiple iterations of high fidelity mockups and gathering user feedback.

Phase Two: The Problem

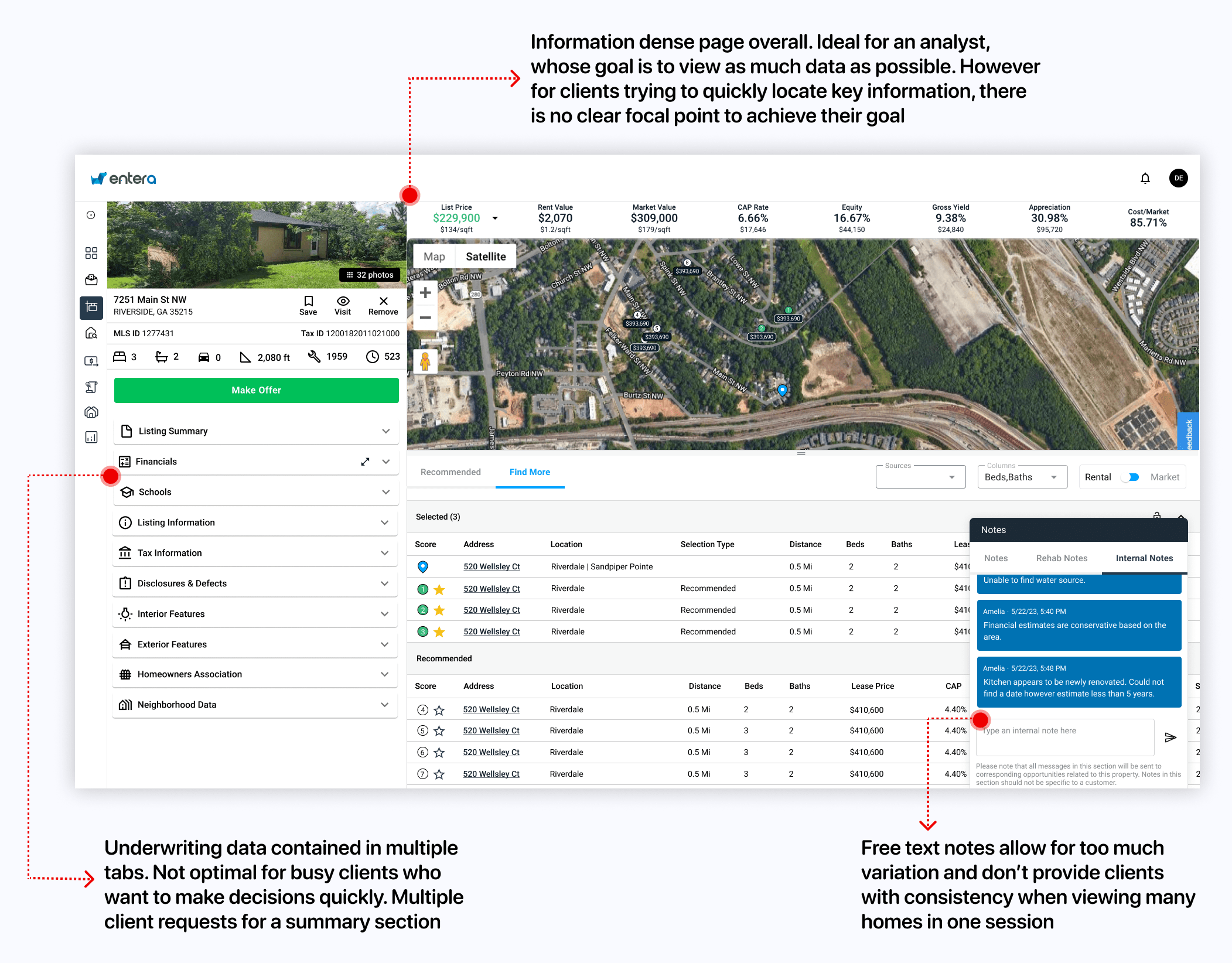

At Entera, the internal analysts had one main goal when underwriting a home for sale: Communicate the value of the home as quickly and effectively as possible, so that clients can take swift action (i.e. make an offer on the home).

Underwriting a home is a step by step process that is relatively standardized, and Entera has its own company standard. However as the company grew, a couple of major problems emerged:

1. Underwriting Consistency Issues

Each internal analyst performed their underwrites a little differently based on personal preference. These standards for underwriting existed primarily in google docs and the analysts’ own heads, but it wasn’t integrated into their workflow on the platform itself. The result was many inconsistencies in what was supposed to be company standard work.

2. Unsatisfied Clients

Busy clients complained of an information dense property detail page, which restricted them from seeing the value of a home quickly enough to take action before their competitors did. This led to multiple client requests for a summary of key details for an underwrite on a particular home. Currently internal analysts could only capture summaries in a free text notes section, with no standardized format that was easily digestible for clients.

Entera wanted to make it mandatory for internal analysts to complete the company standard underwrite on all homes, and translate this into a summary that was consistent in both information captured and layout. This would become especially important once sharing an underwrite for one home to multiple client accounts was enabled (as outlined in phase one).

The Solution

My role in this phase was more exploratory and iterative than it was in phase one, as the concept was less scoped out when I became involved. The basic concept was:

1. An Underwriting 'Wizard'

A form with the company standard underwriting steps in question/answer format. Key requirements established in later discussions were:

- The entire form should be accessible on the page of the home being underwritten

- The form should not obstruct key information on the home’s detail page

- The form should have mandatory steps restricting submission until completed

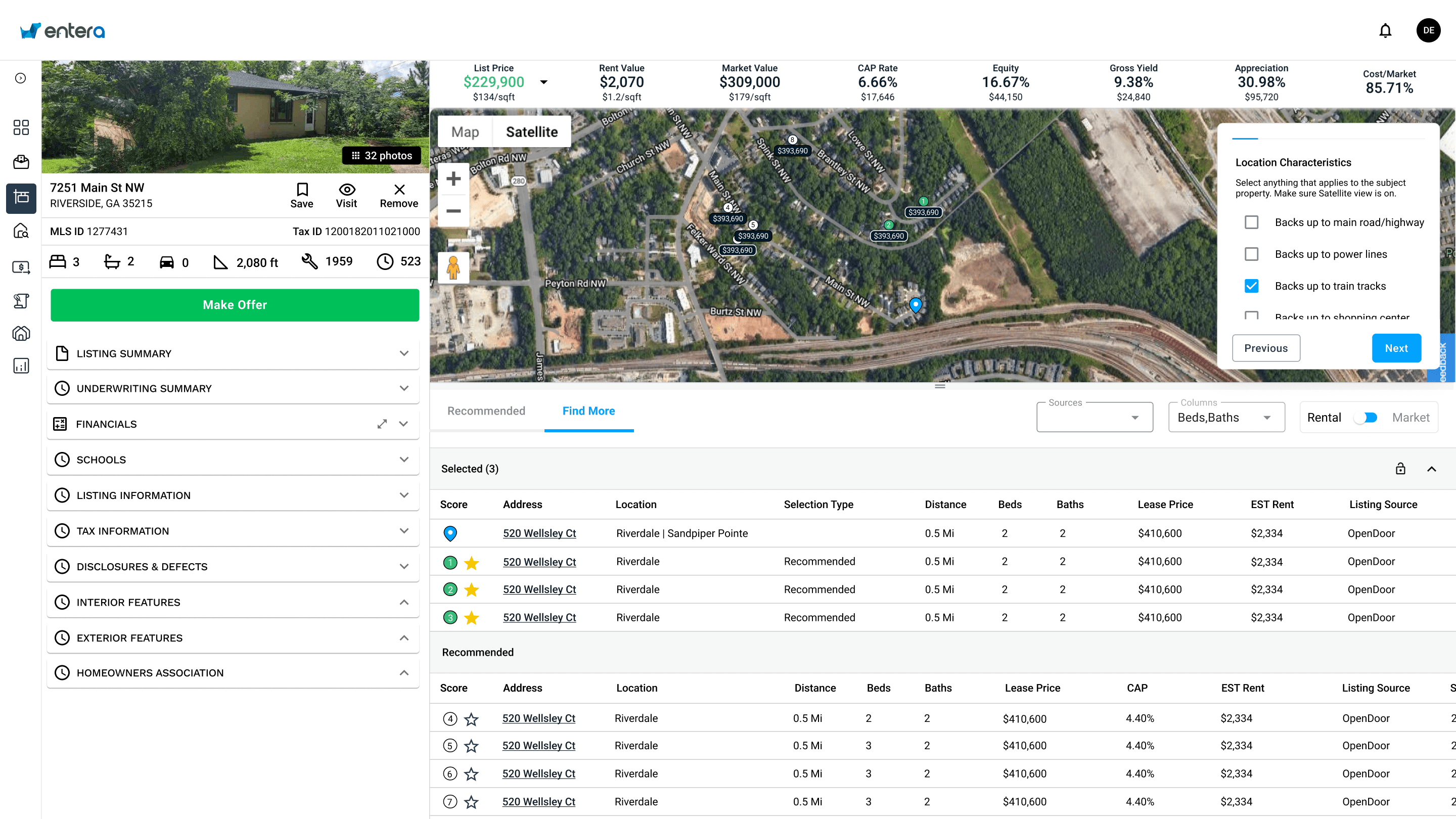

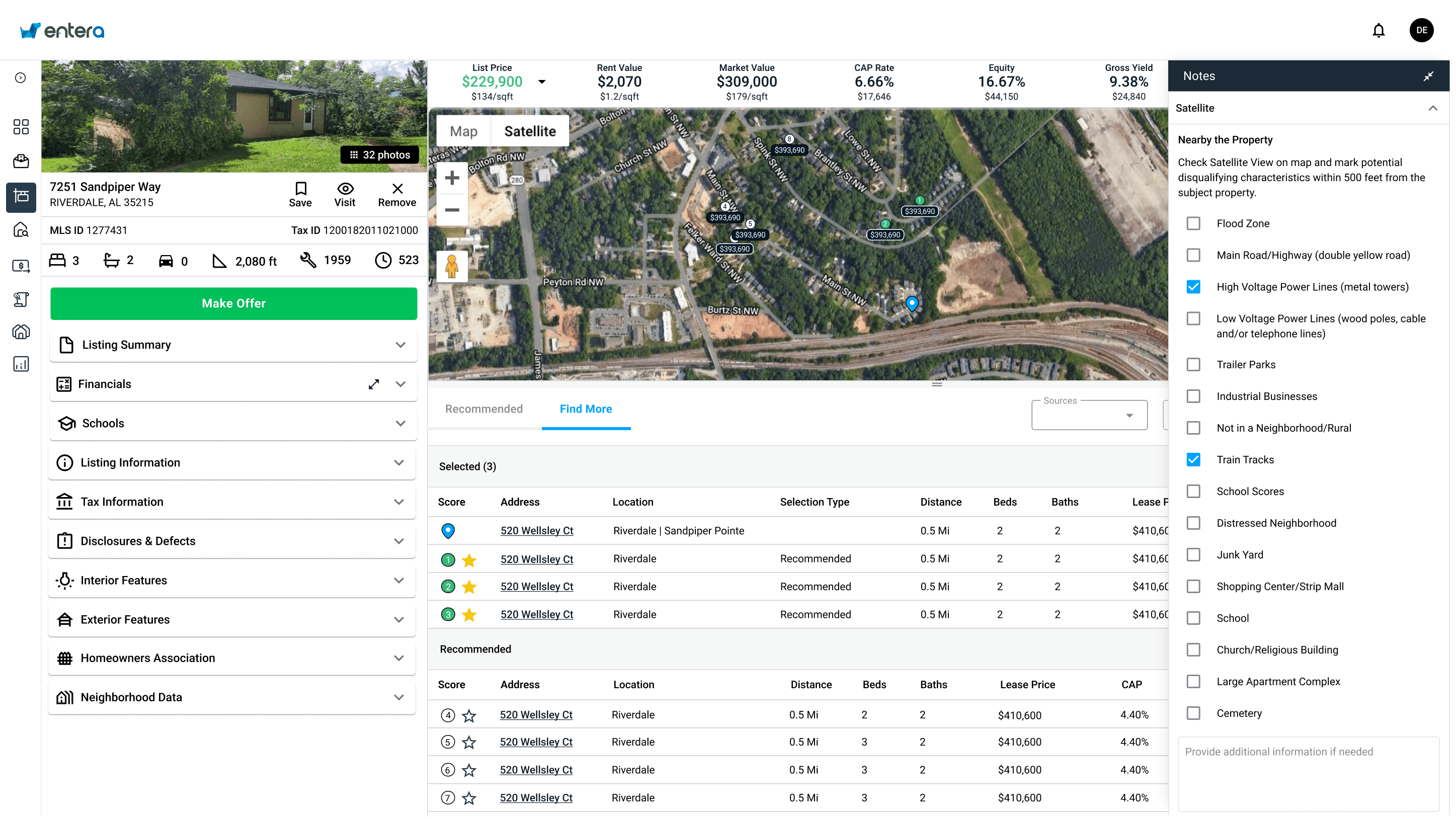

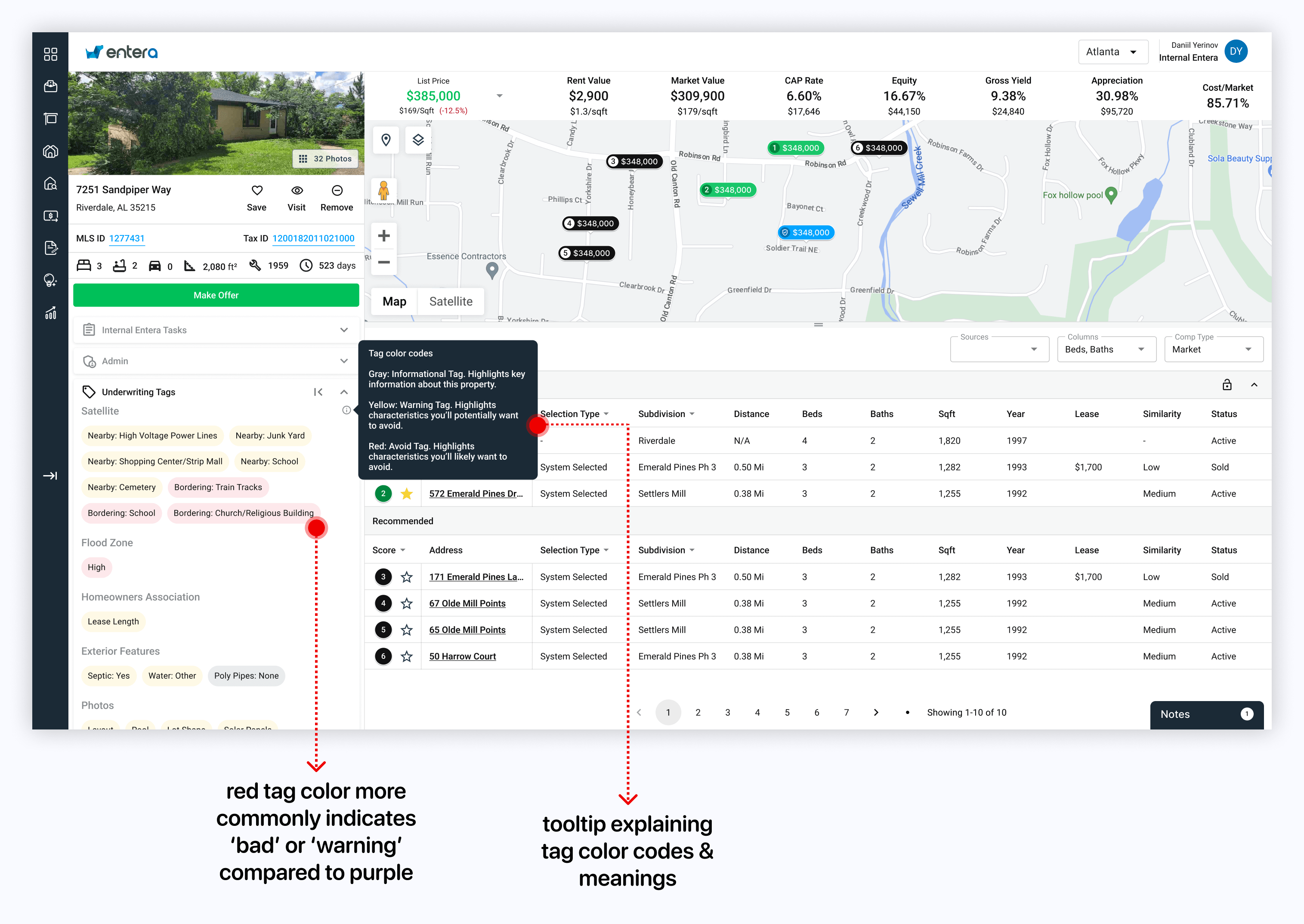

2. Underwriting Tags and Notes

Upon form submission, the answers should appear as a combination of tags and notes on the home’s detail page. These should provide a summary of the underwrite with enough detail and consistency for clients to take swift action on the home. These would be viewable for both internal analysts and client accounts.

My Role

I attended regular meetings with the project PM and internal analyst team leads to:

- Understand and confirm user needs for three user groups:

- junior internal analysts who were completing the wizard

- analyst team leads who were reviewing that work

- clients who wanted to view key insights from the underwrite

- Capture requirements and translate these to user flows and features

- Generate the questions for each step and word them in a user friendly way

- Discuss ideas and present high fidelity wireframes for the UX and UI for the ‘wizard’

Design Iterations

The above discussions led to three main iterations, outlined below…

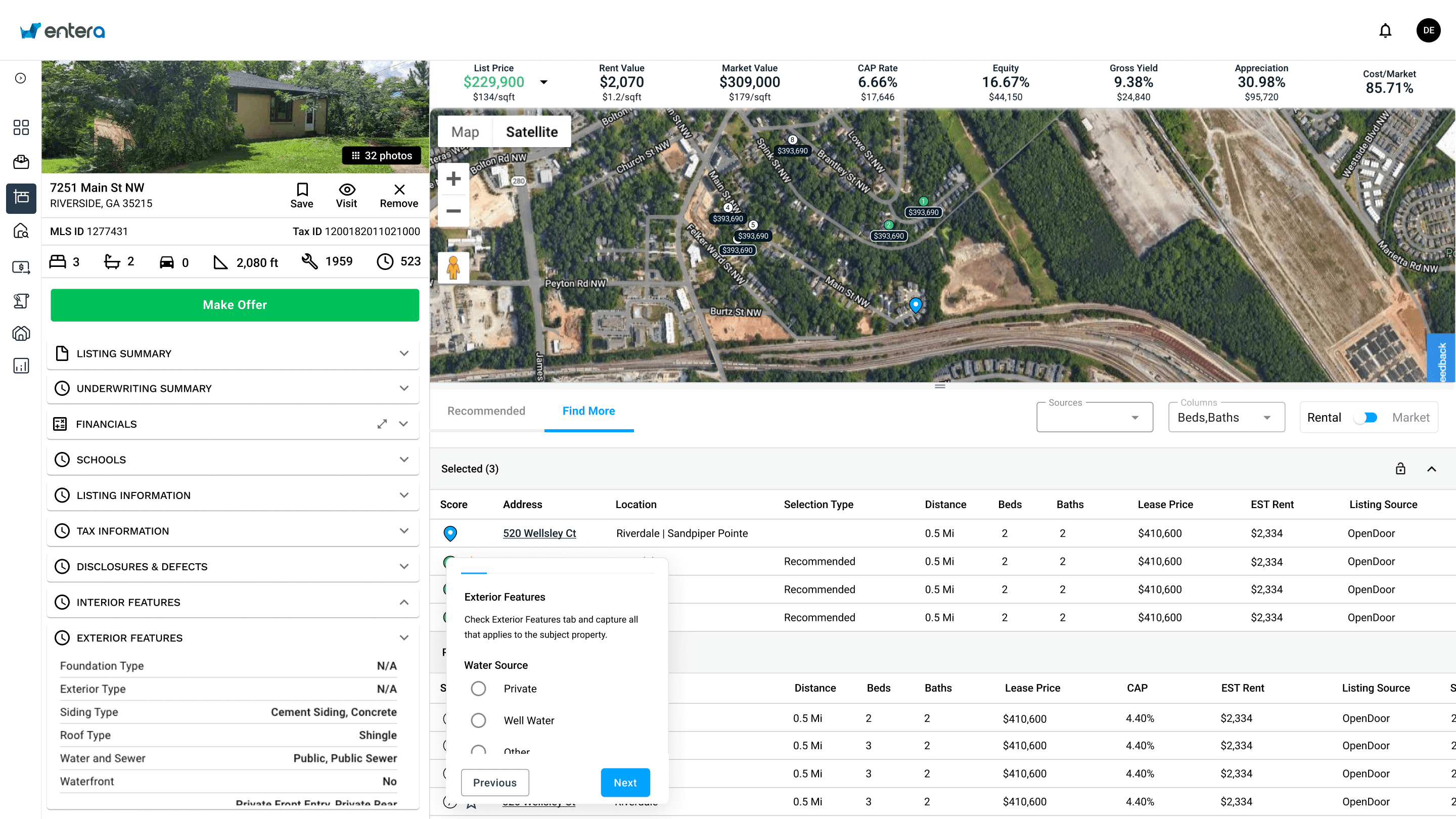

Iteration One: A step by step wizard that followed analyst around the screen

This was the initial idea suggested by the internal analysts. This was a true wizard format where a dialog box containing the relevant questions would appear in different areas of the screen, depending on which underwriting step was being completed.

This idea was discarded because it forced the analysts to complete the underwrite in a particular order. After user research we concluded that:

- Ensuring that all the steps were completed at some point was more important than the actual order in which the steps are done

- While the steps are mandatory, each analyst had their own preferences in terms of the order, and forcing them to change their workflows was too great a cost

In later iterations, emphasis was placed on verification errors just to make sure all steps were completed at some point during the underwrite.

There were also concerns about the idea of the dialogue box changing positions around the screen, as well as not being able to view all the steps simultaneously. After user testing this was determined to be too jarring to the experience.

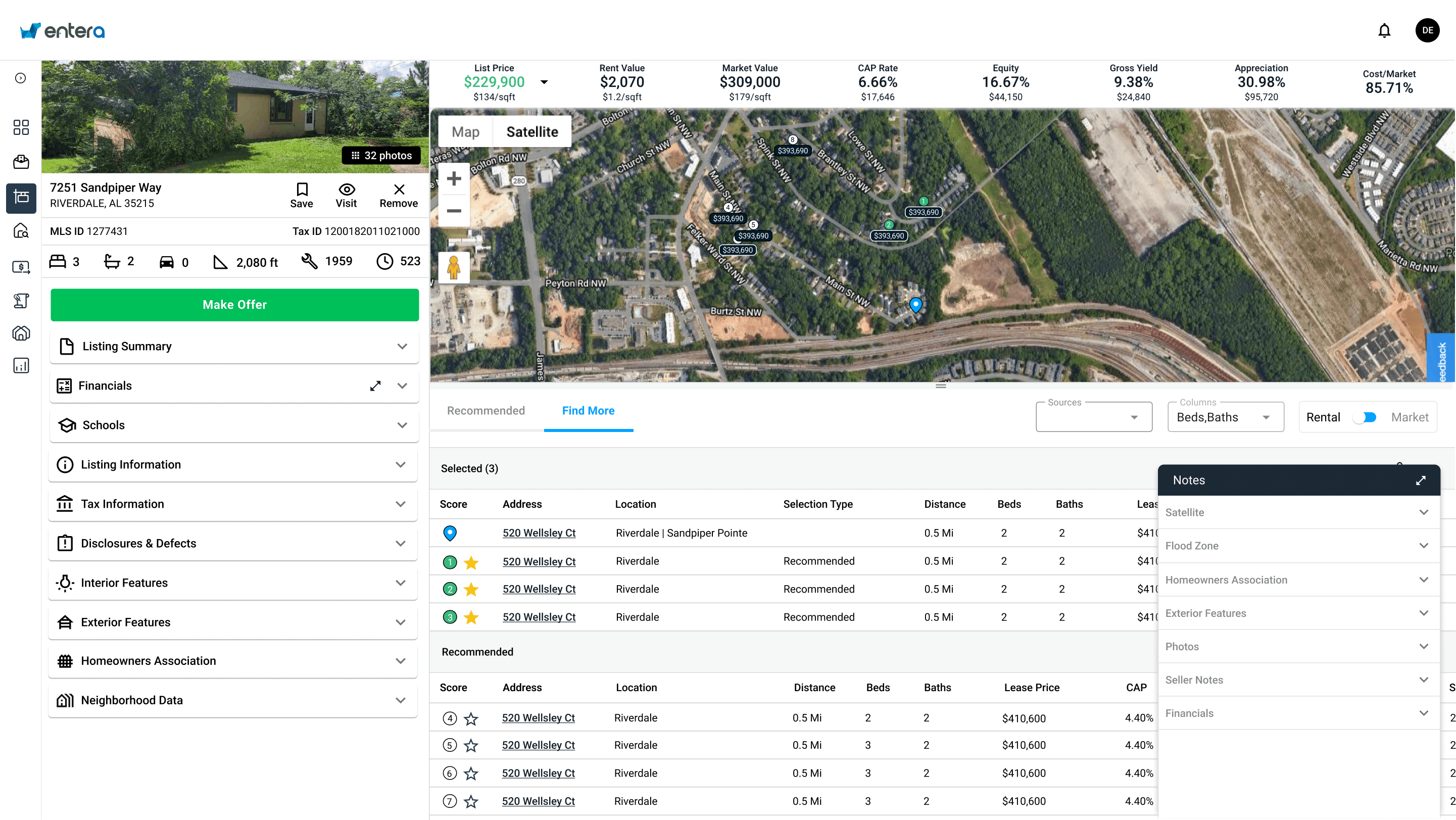

Iteration Two: A form in the notes section

A second idea that I proposed was to repurpose an existing pattern on the home detail page - the free text notes section. The current notes section was used by analysts to call out key information or make additional clarifications about their underwrite. There had been initial discussions about potentially having the underwriting tags (which resulted from completing the wizard) replace the need for notes. So, I thought we could repurpose the component that was already built. An additional feature I suggested was a way to expand the notes section, since some underwriting steps included many questions.

This idea had to be discarded because there were future projects on the roadmap involving enhancements to the notes section in its current state. Additionally, there were concerns that navigating the notes section could be cumbersome since there was an extra click involved to expand. Plus, the notes in the expanded state obstructed some key information and actions on the page used to complete underwrites quickly.

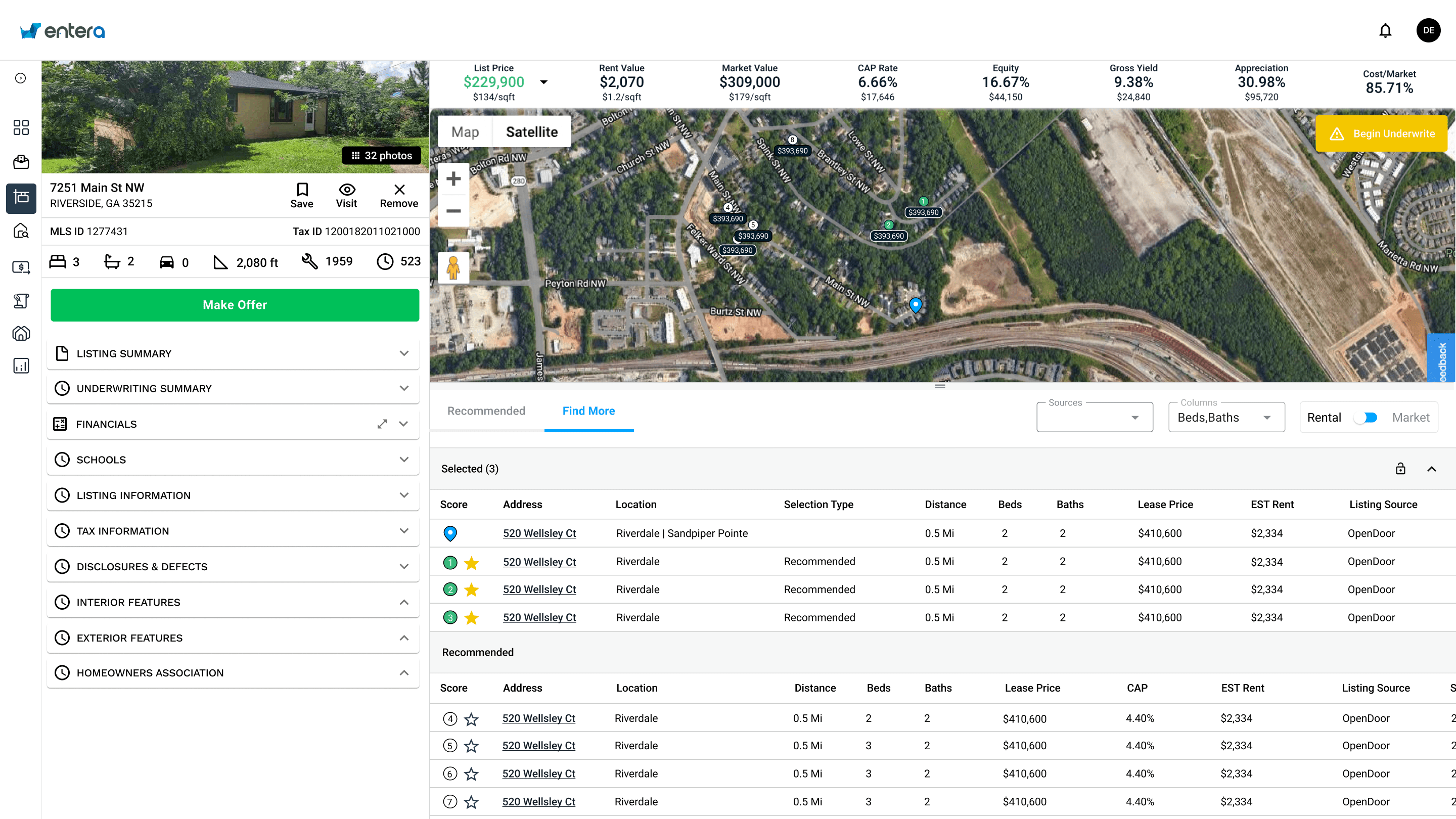

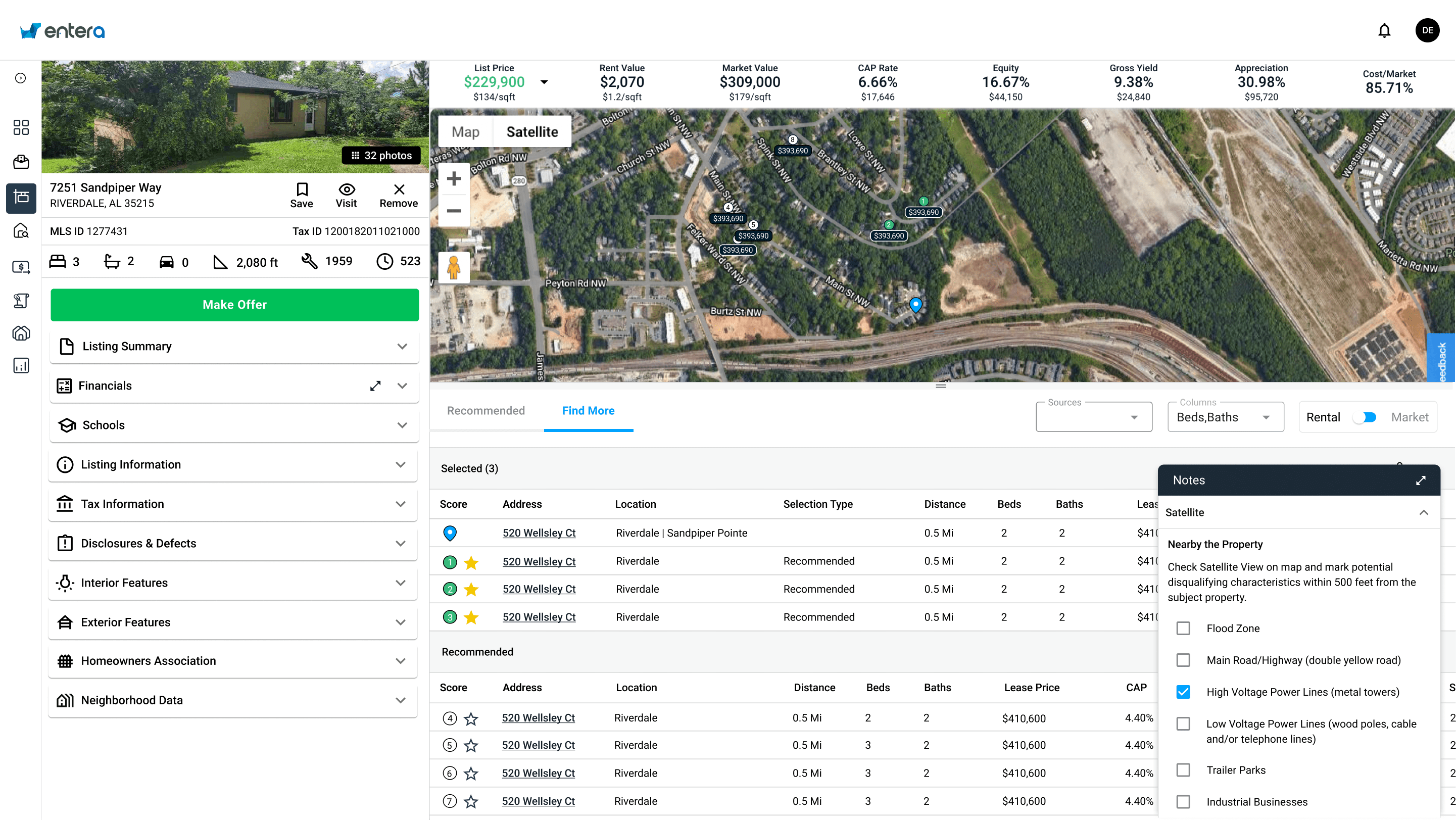

Iteration Three: A form that opens in an additional panel

I workshopped this idea with the Director of Engineering (aka my boss at Entera) while we were discussing ideas for a concurrent project I was assigned to. There had been multiple user requests to add an expand button to the accordions in the left-side menu on the home detail page, since some of these were very info/text heavy and took a long time to scroll through to find key information.

We realized we could expand this idea to the underwriting wizard project by:

- Adding a new accordion menu to contain the tags that resulted from completing the wizard

- Having an expand button on the new accordion menu that would open the underwriting wizard (i.e. form)

When presented to the project group, this idea was deemed to be the best fit for the analysts’ workflow and needs. It was also the least disruptive for clients, since they were already used to viewing information in the accordions. The bonus was that we could get a head start on establishing a pattern for the expand accordion feature which had been requested.

Junior Analyst View: Starting the underwrite

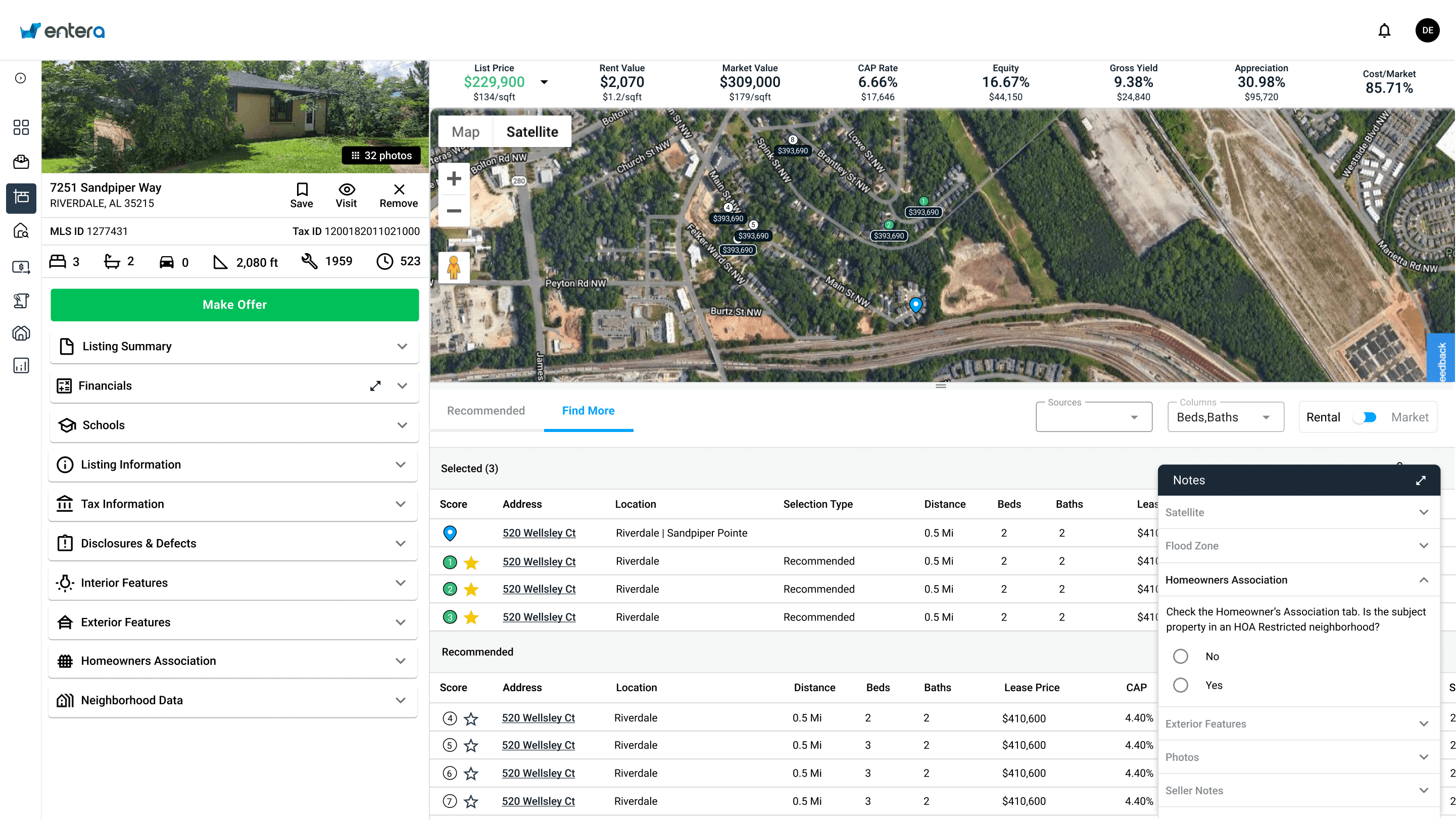

Analyst Team Lead View: Reviewing the underwrite

Feedback and Impact

The new tools were received positively, with some minor usability issues reported that were scheduled for a future release. Notable feedback included:

- Junior analysts: The wizard took the guesswork out of the underwriting process, so they could just focus on completing the steps competently. This decreased the time it took to complete a single underwrite, enabling them to hit their targets more easily

- Analyst team leads: The tags section made it much faster to review the junior analysts’ work, and easily make edits or additional comments if needed (previously they needed to read through the free text notes). This meant they could focus on adding value to the underwrite for the client, rather than spending too much time checking work or doing the entire underwrites themselves

- Clients: The project delivered a summary of key details in the form of tags, which were much quicker to review than free text notes (especially with the help of the color coded tags). This meant clients could take the necessary actions on homes faster than before, increasing their overall activity and transaction volume on the platform

Client View with Feedback Implemented

Single Family Real Estate Investment Platform For Investors

Entera is a 3-sided marketplace focused on connecting Enterprise and Mid-Market investors, sellers and services providers in the single-family residential market. Powered by modern data science and Artificial Intelligence (AI), Entera’s marketplace offers the most seamless solution for investors to access, evaluate, transact and operate their single-family real estate investments.

As a UX/UI designer at Entera, I worked closely with the director of engineering, design teammates, product managers, and senior developers on projects to increase users’ speed and effectiveness in discovering and analyzing residential real estate for purchase at scale.